The next generation of retail brands

by Jack SallabankDebenhams may have become the poster child for the big-box retailer failing to move with the times, but another high street name that has acquired an unwelcome reputation as being too big and old to evolve is Marks & Spencer. However, an innovative joint venture between M&S and Founders Factory – called Founders Factory Retail – suggests that change for the high street retailer is afoot.

Founders Factory Retail is an incubator and accelerator model which seeks to support the growth of six start-up retail brands a year. At the end of its three-year programme, the JV will have seen 18 new retail brands come to market, with 3 built from scratch and 15 invested in and accelerated to market.

For Isabela Chick, Managing Director of Founders Factory Retail, the venture is a clear sign of the ambition of M&S, led by CEO Steve Rose, to transform itself. “They understand that to evolve they need to have skin in the game and actually work with start-ups. That means co-create with start-ups, invest in them, test with them and ultimately help them scale.”

Isabela Chick

Founders Factory Retail

Alice Sandelson (left) and Erin Booth (right)

Founders Factory

Founders Factory, started in 2015 by co-founder of Lastminute.com Brent Hoberman and Henry Lane Fox, has recruited an impressive team to help identify and provide bespoke support for its portfolio of start-ups. The fund invests in start-ups early, typically pre-seed to Series A, and seeks start-ups that have identified a market opportunity, come up with a good idea to address it and established a strong founding team.

Working alongside M&S and the new breed of retail start-ups, Chick is in a unique position to identify the drivers of change in the retail market. “There are three axes retail is changing on. Consumers are interacting with the retail space differently, they are interacting with different brands and in a different way, and their expectations of convenience and fulfilment are now very different.”

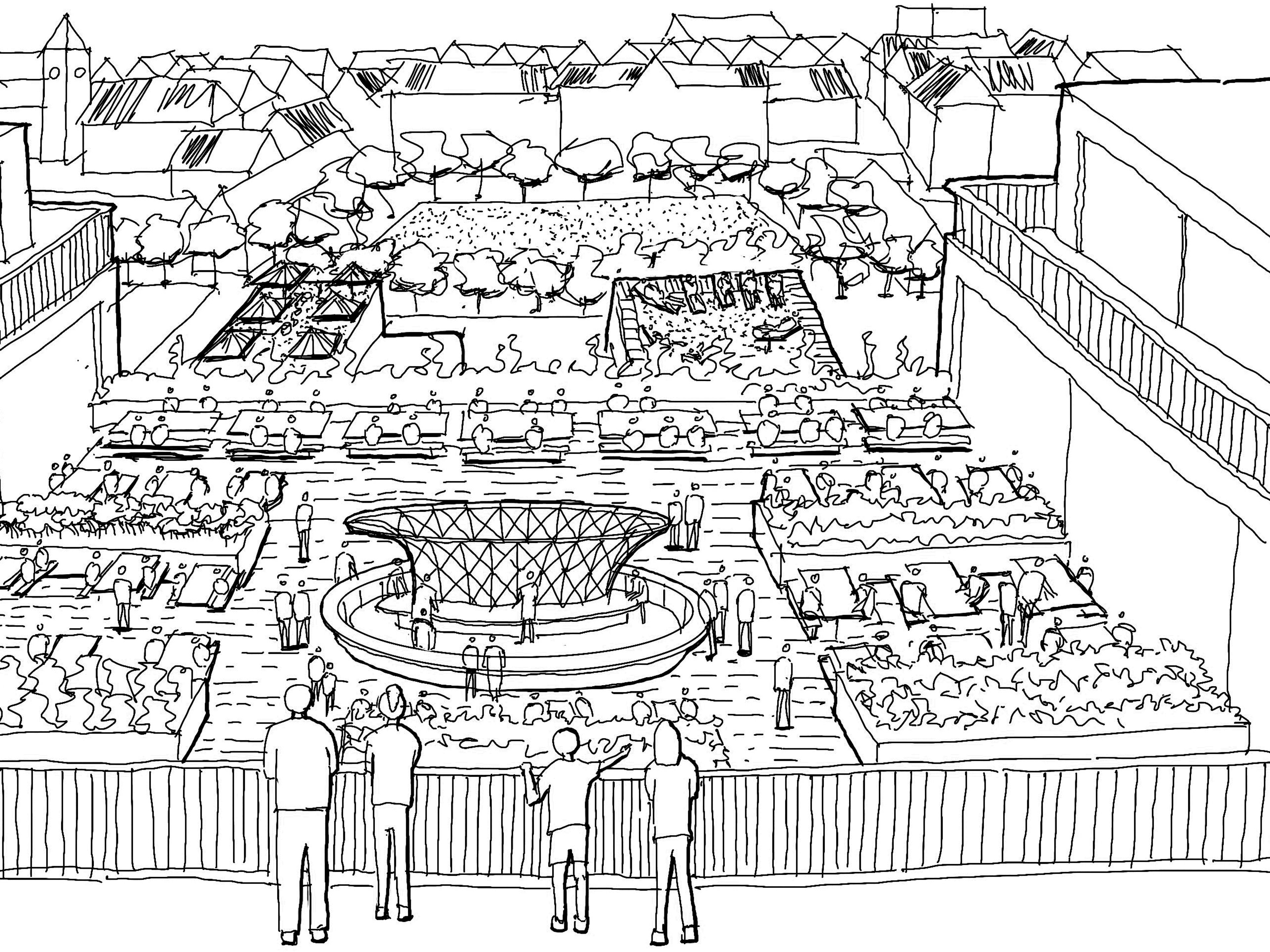

This consumer-led change is shifting the retail space from a place where customers access stock to one where a brand tells its story and interacts with customers on a deeper level. For the start-ups coming through Founders Factory, having their own retail space may not be the strategy; instead they might opt for a shared physical space with like-minded brands, a requirement some retailers are responding to.

“Big retailers are diversifying their offering to incorporate much smaller brands, which means the whole nature of what retail looks like is changing from one store/one brand to multiple brands and a different nature of how one shops around the store,” explains Alice Sandelson, Head of Partnerships at Founders Factory.

Consumers are interacting with retail spaces differently.

Pop-ups introduce different brands to the market.

For Erin Booth, Head of Beauty and Retail Investments, this move from retailers is a return to a shopping of old. “Historically, you would go to your butcher for the best meat, your baker for the best bread and your shirt-maker for your favourite shirts. In recent history, we have shifted to a big retailer model, with one brand catering for everything in one place. Now, though, we are seeing the consumer push back against the massive retailer-type model, and we’re going back to an older way of shopping.”

A return to the ‘mom and pop’-style retailer of yesteryear has in turn led to the emergence of a marketplace leasing model in which one brand takes the headline lease on a space and then sublets that space to smaller brands. Such a model has been seen at Coal Drops Yard with the launch of Wolf & Badger, which describes itself as a “curated marketplace for independent brands.”

For Chick, the Wolf & Badger model is a welcome move and one we can expect to see more of with the growth of a WeWork-style offering for retail spaces. “We will see a turnkey solution for retailers, with high-spec spaces with full-on services that you can turn on and off. Ultimately, these new brands coming onto the market won’t have a ‘Head of Retail Space’ and instead will benefit from a supplier who offers a ‘space as a service’ model.”

To see the impact a WeWork-style model can have on a traditional leasing market, the retail world should look no further than the disruption caused in the office world. Not only should the office analogy provide an important lesson for retail landlords, but it should also point them in the direction of one of their key priorities: data.

“Data in the retail space will become vitally important,” says Booth. “How do brands understand what their customers want? In the retail space, brands can engage with their customers; they can collect information through IoT devices and in-store surveys or questionnaires.”

While headlines predict the death of physical retail, a morning spent with the team at Founders Factory Retail and some of its cohorts illustrates that the opposite is the case.

But as the next chapter of retail continues to unfold, more brands will fall away as the battle for consumer engagement intensifies. For those brands big and small that seek to prosper, success will be defined by their ability to pivot their offer and brand to be relevant, unique and meaningful to the modern consumer. Teaming up with and investing in the bright minds coming out of Founders Factory Retail might prove to be a very wise decision for M&S.

At a Founders Factory pop-up event, we met representatives from three new brands bringing bright ideas to life.

Jonathan Kruger

CEO, The Drop

The Drop is changing the way menswear is made, discovered and bought by building a sustainable fashion supply chain for the future.

You’re currently an online brand. Will you always be online only?

I always used to think we would be an online only brand, but having some sort of physical presence, albeit small but impactful, is very important for building trust and customer relationships. We are very light on overheads, so it wouldn’t make sense to have a permanent location; we might do a series of pop-ups or a concession model where we work with a big established retailer.

Sergey Klimentyev

Founder and CEO, Texel

Texel develops and manufactures solutions that enable high-precision 3D capture, measurement and analysis of the human body.

Your product helps make the retail experience easier for the consumer. Do you see a future for offline retail?

Yes, we don’t feel like offline is dying. It is definitely going through a change, but it is more like a spiral, and it is going through a period of change where offline will transition from being a place just to shop to a place where we can see a demo of products and it’s easier to engage with different types of products.

Arunus Matacius

Founder, Rocketo

ROCKETO is reinventing dog food by combining the benefits of raw feeding with the convenience of dry food.

You’re about to launch in M&S. How important is having a physical retail presence for your brand?

For brand building, for awareness, for sales, no one can beat having a physical presence. People want to touch a product, read the labels and learn about the brand. We often see that big online brands are now going into physical retail, but we chose the path of physical retail and online retail from day one.

Tags

Authors

Jack Sallabank is the founder of Future Places Studio, a place-based research and strategy studio that specialises in exploring the macro and micro trends impacting the built environment.

Isabela Chick, Managing Director of Founders Factory Retail, runs an accelerator business finding the next generation of retail brands.

Alice Sandelson, Head of Partnerships at Founders Factory, works with the

next generation of retail brands.

Erin Booth, Head of Beauty and Retail Investments at Founders Factory, is tasked with finding the next generation of retail brands.

Publication

This article appeared in Exchange Issue No. 2, which explores the changing nature of the retail sector with contributions and design analysis from leading retailers, developers, consultants and more.

Read more