The changing nature of retail leasing

by Richard ScottThere are several economic factors playing their part in reduced retail demand – a perfect storm, if you like. The B-word (Brexit) is undoubtedly deterring investment into London from some quarters, but others are able to see past this. More importantly, the other B (business rates) has had a dramatic effect on total occupancy cost, with the result that many retailers simply cannot afford to trade from a large part of the store portfolio.

There’s no doubt that the retailer requirement for a 100-plus store portfolio is limited now. Only key shopping centres and major London thoroughfares and districts will meet the new retail criteria.

Probably more important than these factors is the change in shopping habits that is here to stay and will shape the future of physical store requirements. ‘Phygital’ is the new term, and I like this.

Phygital is a marriage of online and physical store environments. Customers want to try and feel the product while enjoying the benefits of the digital experience in store and then potentially completing the purchase at home, online. Retailers such as the furniture brand MADE have embraced a forward-looking retail experience that directs customers into the store, where they use a tablet to view prices and product information and ultimately make their purchases; there are no tills. This in-store experience is less about selling from every square foot than conventional retail models.

At Nash Bond we are actively engaged with many online retailers from overseas seeking a physical store presence in the UK. They know that a physical store offers a window for the customer to experience the brand and interact with the product, though not every store needs to be an Apple store. In any case, good personal service is undoubtedly a benchmark for success.

It comes as no surprise to me that store turnovers are dropping, but the property industry should really have a new metric for understanding the value of a physical store to the retailer’s overall turnover. The future of retail is not physical or digital; it is phygital.

It is clear that neither landlords nor tenants have the detailed information to understand where the sale is actually made, and while this continues, and with wider economic factors at play, the retailers will seek to use this as an opportunity to drive the best possible leasing terms. Why wouldn’t they? Continued collaboration between parties can only assist with future placemaking.

Flexible leasing is becoming more commonplace, by way of shorter lease terms, options to break and the rise of pop-up stores. These have always been present, but some forward-thinking online businesses have created platforms to make it easier for global brands to secure flexible leases.

Surely all leases will be short-term in the future. Market forces – simply supply and demand – will shape this. The pop-up market has seen some take up, but for the majority of retail sites, most retailers need time to garner a loyal customer base.

The best sites on the best streets are still in strong demand. Importantly, many landlords are keen to let their estate or shopping centre with a collection of lease lengths and flexible leasing as they seek out all types of brands that can invigorate their destinations. Often it can be the retailer that becomes stale and needs refreshing, and in this case a long lease is not preferable for the landlord.

The landlord and retailer relationship hasn’t changed, but the nature of retailing is. Both parties are having to work ever closer together and learn the new language.

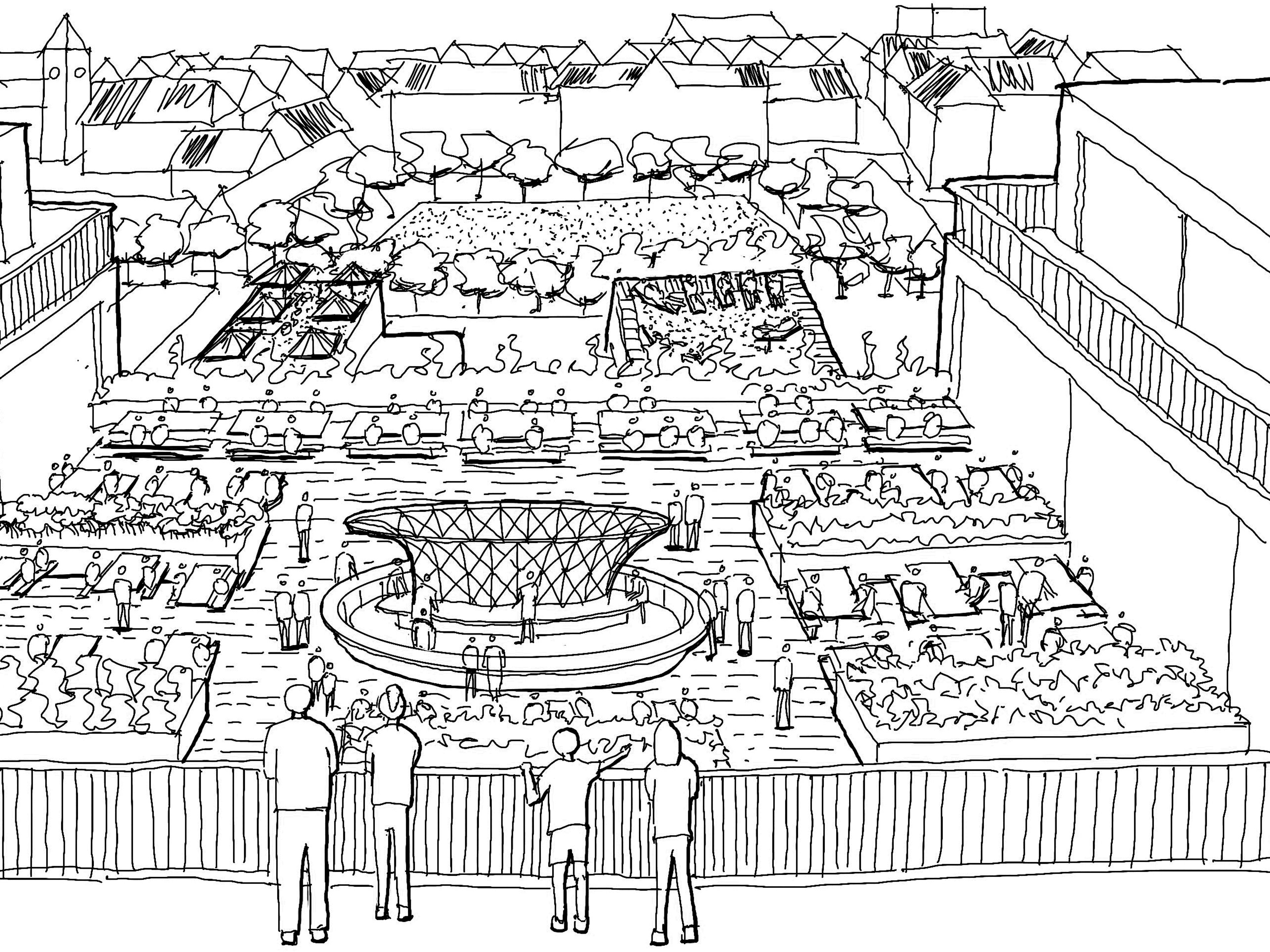

The Make-designed retail kiosks in Canary Wharf are designed to double as pieces of art.

Tags

Authors

Richard Scott, Director of Nash Bond, is an agent for the London-based retail advisory firm.

Publication

This article appeared in Exchange Issue No. 2, which explores the changing nature of the retail sector with contributions and design analysis from leading retailers, developers, consultants and more.

Read more