Interview with Ibrahim Ibrahim, Portland Design

“The physical retail space ceases to be a piece of property and becomes a piece of media.”

Jack Sallabank: What is your view on the current retail situation?

Ibrahim Irahim: My starting point is to ask what retail is supposed to be about. That is four things: recruitment, transaction, fulfilment and retention. Find a customer, sell them something, get it to them, and encourage them to come back. Those four things are still very relevant, but what is driving change is that the transaction and fulfilment part is increasingly moving away from the physical space and appearing online. That leaves the idea that the physical space is more about recruitment and retention. If we accept that, it changes everything. It means that the physical space needs to change in its experience and in its ability to programme; it affects its location and its connectivity with other experiences and the public realm around it. Most importantly it changes the revenue model, and it changes the valuation model of the asset. That is what’s exercising everybody and creating the real disruption.

JS: How does this affect the traditional business model of a retail space?

II: The physical space ceases, to a certain extent, to be a transaction space. Therefore, it ceases to be a piece of property and becomes a piece of media. If we accept that it is a piece of media and has a different type of revenue potential, we then accept that the asset is not just the physical space – ie, the real estate; the asset is what brings the revenue. What brings the revenue or what determines the revenue is the data. So valuations of the space won’t be based on if it's 1m2 or 20m2; it will be based on who’s passing, what they’re doing and why they’re doing it.

The KPIs of a retail space have been disrupted, and therefore the value of the physical asset cannot be determined by just what products are sold; its ability to influence a series of behaviours also matters. Those behaviours could be traffic to a website or photographing and sharing on social media.

JS: The value of the space could therefore change on an hourly basis…

II: Absolutely. If it’s a media platform and ceases just to be a piece of real estate, its success will be determined by its ability to programme itself and change and be fluid like a piece of media. The way all this affects designers is that it’s no longer about shelves and glass fronts; it’s about creating a stage, a platform that is completely programmable with technology, sound and multi-sensory experiences. It allows a brand to not just sell its stuff but tell its story.

Far from the internet killing shops, it will actually liberate them. It’s this liberation that’s interesting. It opens the door to a whole host of new players who haven’t seen a physical space as a channel and normally use their media spend on media. Now we’re saying that part of that media spend can be used on the physical space. The asset owners that can understand that and have the balls to invest and change the way they view space are the ones that will win.

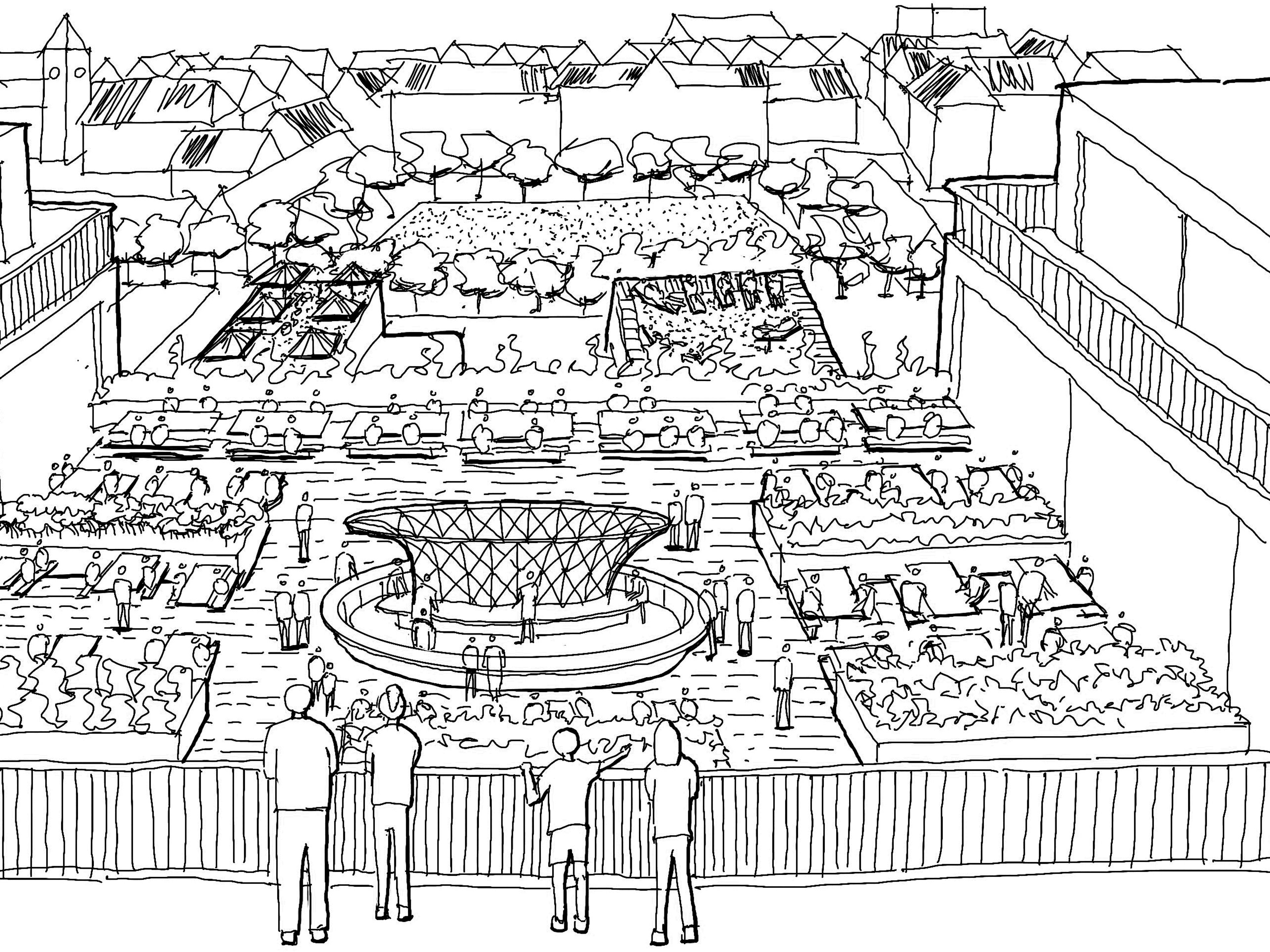

Intema Yasam is a hybrid F&B and retail concept by Portland Design in Istanbul, Turkey.

Pink Fish is a new F&B concept by Portland Design in Oslo, Norway.

JS: What are the behavioural trends of consumers that are driving this change?

II: We believe it is a series of things. It’s a busier and busier life. There’s a demand for consumers to have asset-light lives, with less and less stuff. It’s a change of habit where people are less committed; they’re commitment-phobes. We’ve seen a reaction against big brands, a massive trend in localisation and craft. Death of the logo, death of cookie-cutter retail – all of that is a reaction against establishment. These are the massive societal changes driving all of this.

Status has always been at the core of consumerism, but what’s interesting is how it’s now flipped from being about what you own to what you choose what not to own.

JS: What will the retail landscape look like in the next five years?

II: There will be a clear-out of retailers that are not relevant. We are seeing the likes of Debenhams and House of Fraser going; I could have told you ten years ago that they are rubbish retailers, and they haven’t changed. Why are those two going bust when in the same industry, with the same set-up, Selfridges grows by 20%? It’s because they aren’t relevant.

I think we’ll see an emergence of some really exciting new players – an emergence of brands that have not been in the physical space sphere. We’ll see a repurposing of assets, and way more hybrid interweaving of different experiences, resulting in a greater convergence of work, shopping, leisure, culture and hospitality. It will be a very interesting time.

Tags

Authors

Ibrahim Ibrahim, Managing Director of Portland Design, has some interesting and provocative views on the future of retail.

Publication

This article appeared in Exchange Issue No. 2, which explores the changing nature of the retail sector with contributions and design analysis from leading retailers, developers, consultants and more.

Read more